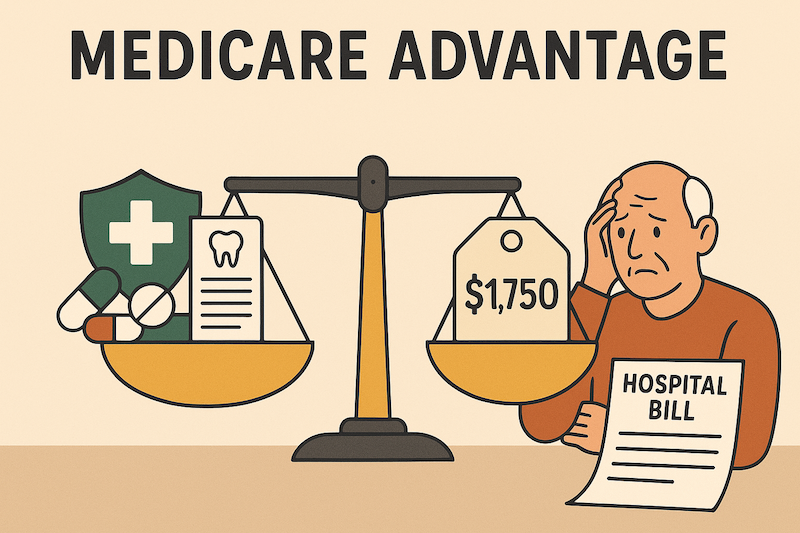

Medicare Advantage Is Strong, But Not Bulletproof

Medicare Advantage is a good fit for many seniors. The premiums are often little to nothing, prescription drug coverage and dental benefits are bundled in, and for healthy folks or those on tighter budgets, it feels like a no-brainer.

But here’s the truth: Medicare Advantage is a cost-sharing plan. Every doctor visit, every test, every ambulance ride, and especially every hospital stay comes with a price tag.

And when a client who thought they were “covered” suddenly faces $1,750 in hospital co-pays from a single stay, they’re not going to blame Medicare Advantage. They’re going to blame you.

This is why you should get into the habit of presenting a hospital indemnity plan to all Medicare Advantage clients.

The Real Problem: Hospital Costs Under Medicare Advantage

Here’s a common scenario:

-

Daily hospital co-pay: $350

-

Days billed: 5

-

Total exposure: $1,750 out of pocket

On a fixed income, that’s not just a bill. That’s a disaster.

And it doesn’t stop at the hospital doors:

-

Skilled nursing facilities often only cover the first 20 days. After that, your client is on the hook.

-

Ambulance rides can cost $200–$300 each.

These are everyday realities for seniors. Not “maybe” expenses.

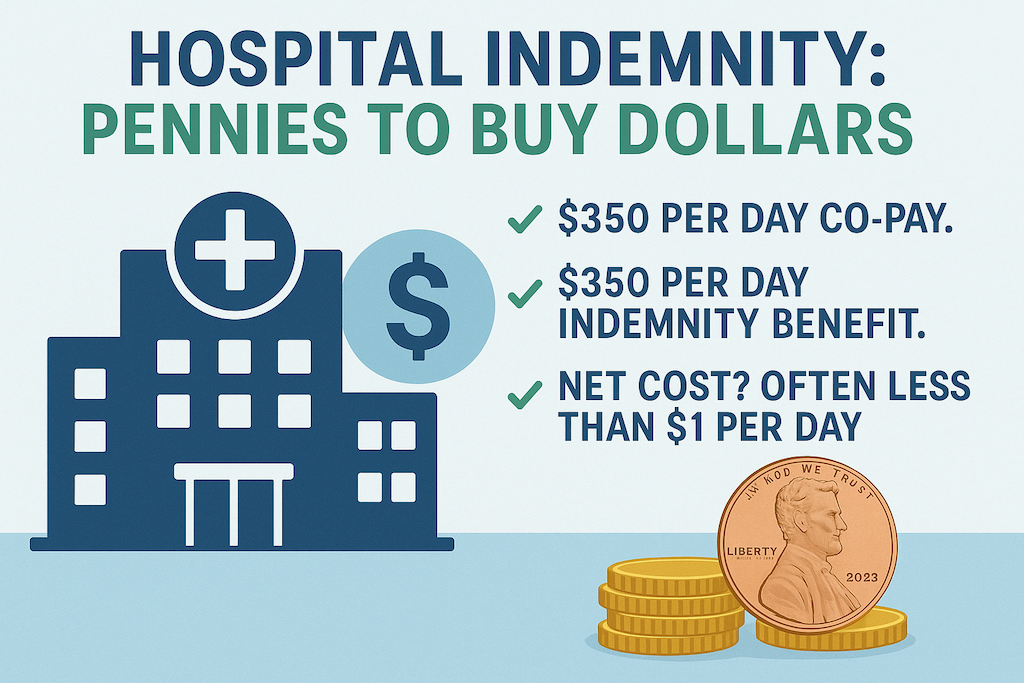

Hospital Indemnity: Pennies to Buy Dollars

A hospital indemnity plan pays a set amount directly to the client for each night they spend in the hospital. In most cases, it matches the exact co-pay charged under their Medicare Advantage plan.

✅ $350 per day co-pay.

✅ $350 per day indemnity benefit.

✅ Net cost? Often less than $1 per day.

That’s pennies buying dollars. It’s predictable, budgetable, and it keeps your client from draining savings or racking up credit card debt after a hospital stay.

Riders That Fill the Gaps

The real power of hospital indemnity is in the add-ons:

-

Skilled Nursing Rider – Covers the daily co-pays after Medicare Advantage stops at day 20.

-

Ambulance Rider – Pays $200–$300 per ride, even if the MA plan waives the co-pay. (That’s money in the client’s pocket.)

-

Cancer Rider – Helps cover the 20% co-insurance for chemo or radiation.

These riders solve the exact problems that stress out seniors and create financial strain.

Proof Points From Real Clients

📌 Hospital stay covered

One client with a Medicare Advantage plan had a 5-day hospital stay. Their bill should have been $1,750. Their indemnity plan paid every penny—for less than $23 a month in premiums.

📌 Skilled nursing rider saved $3,000

Another client needed extended rehab. Their MA plan only covered the first 20 days. The indemnity rider picked up the rest, saving them thousands.

📌 Ambulance rider paid cash

A client had two ambulance trips in one year ($250 each). Even though their MA plan waived the co-pay, the indemnity plan still paid $500 cash to the client. They used it for groceries and gas.

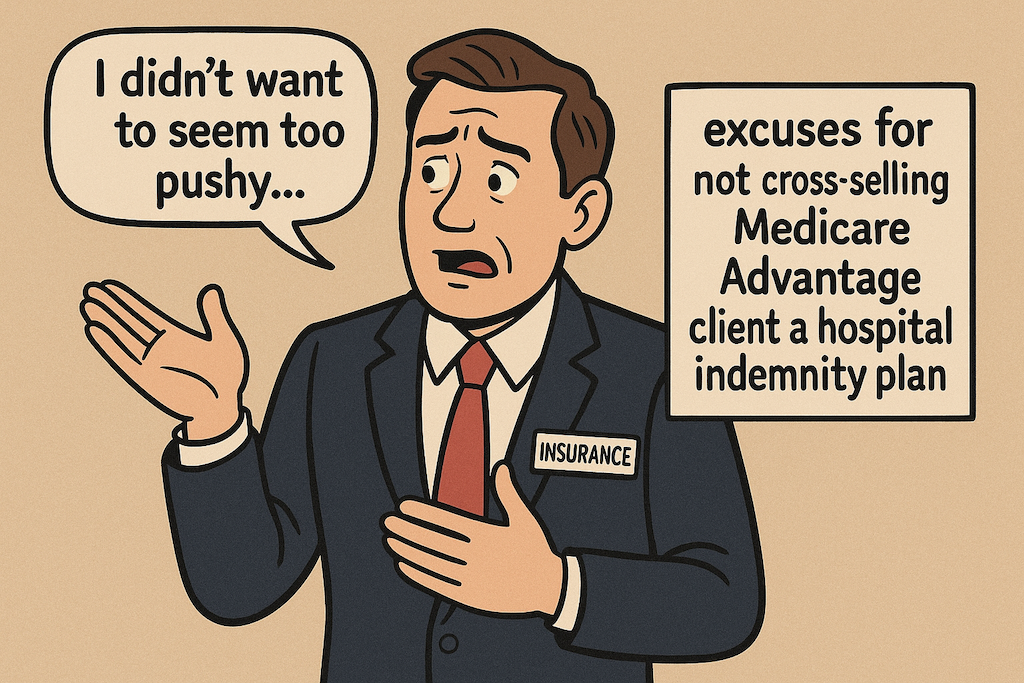

Why Some Agents Skip This (And Why That Doesn’t Fly)

Excuse #1: “I don’t want to seem pushy.”

>Excuse #2: “The client just wanted Medicare Advantage.”

>Excuse #3: “It’s only a couple hundred dollars—they can handle it.”

Here’s the problem: when that hospital bill shows up, they won’t remember what you didn’t want to “push.” They’ll remember you didn’t protect them.

That doesn’t fly.

The Business Case for Cross-Selling

Cross-selling hospital indemnity isn’t just good for clients. It’s good for you.

-

Renewals add up – Every plan adds another stream of steady renewal income.

-

Retention skyrockets – Protected clients don’t shop around. They stay loyal and send referrals.

-

Less stress – Agents who skip indemnity spend hours dealing with angry clients. Those who sell it get thank-you calls instead.

You can either get paid to serve grateful clients—or do unpaid damage control for upset ones.

Don’t Forget the Cancer Exposure

Medicare Advantage has an annual maximum out of pocket. Good news, right?

Here’s the catch: it resets every January 1.

A cancer patient diagnosed in June might hit $7,500 in out-of-pocket costs by December—only to face another $7,500 exposure starting January. That’s $15,000 in less than a year.

This is why pairing a hospital indemnity plan with a lump-sum cancer plan is critical. The indemnity covers hospital co-pays. The cancer plan cuts a check directly to the client—often before treatment even begins.

That’s peace of mind.

Want to learn more about how cancer effects today’s seniors? Download your free copy of Cancer Facts & Figures.

How to Position It With Clients

The script is simple:

-

“Your Medicare Advantage plan charges $350 per day in the hospital, up to 5 days. That’s $1,750.”

-

“Would that kind of bill be a problem on your budget?”

-

“For less than $1 a day, a hospital indemnity plan can cover that gap completely.”

No hard sell. No hype. Just logic. Seniors want predictable costs and no surprises.

Bottom Line

Selling Medicare Advantage without a hospital indemnity plan is like building a boat without a life raft. It’ll float most of the time—but when the storm comes, your client is in trouble.

Hospital indemnity coverage:

-

Protects your clients from surprise hospital bills.

-

Strengthens your business with renewals and referrals.

-

Shows you’re a professional who doesn’t cut corners.

If you’re serious about protecting your clients, cross-selling hospital indemnity isn’t optional. It’s the right thing to do.

So after reading this, we hope now you understand why you should cross-sell a hospital indemnity plan to all your Medicare Advantage clients.

Ready to Protect Your Clients the Right Way?

At Senior Benefit Services, we’ve been helping agents do this the right way for over 30 years. Let us show you how to protect your clients from financial disaster, while building a stronger book of business.

📞 Call us at (800) 924-4727 or reach out online. Let’s make sure no client of yours ever gets blindsided by a hospital bill.