Major Medicare Updates for 2025: What You Need To Know

As we step into 2025, Medicare is unveiling significant updates that could directly impact how beneficiaries manage their healthcare. From cost adjustments to expanded benefits and plan options, staying informed is vital—especially for those guiding clients through these important decisions. Here’s a breakdown of what’s new and noteworthy in Medicare for 2025.

Medicare Costs for 2025

Part B Premium and Deductible Changes

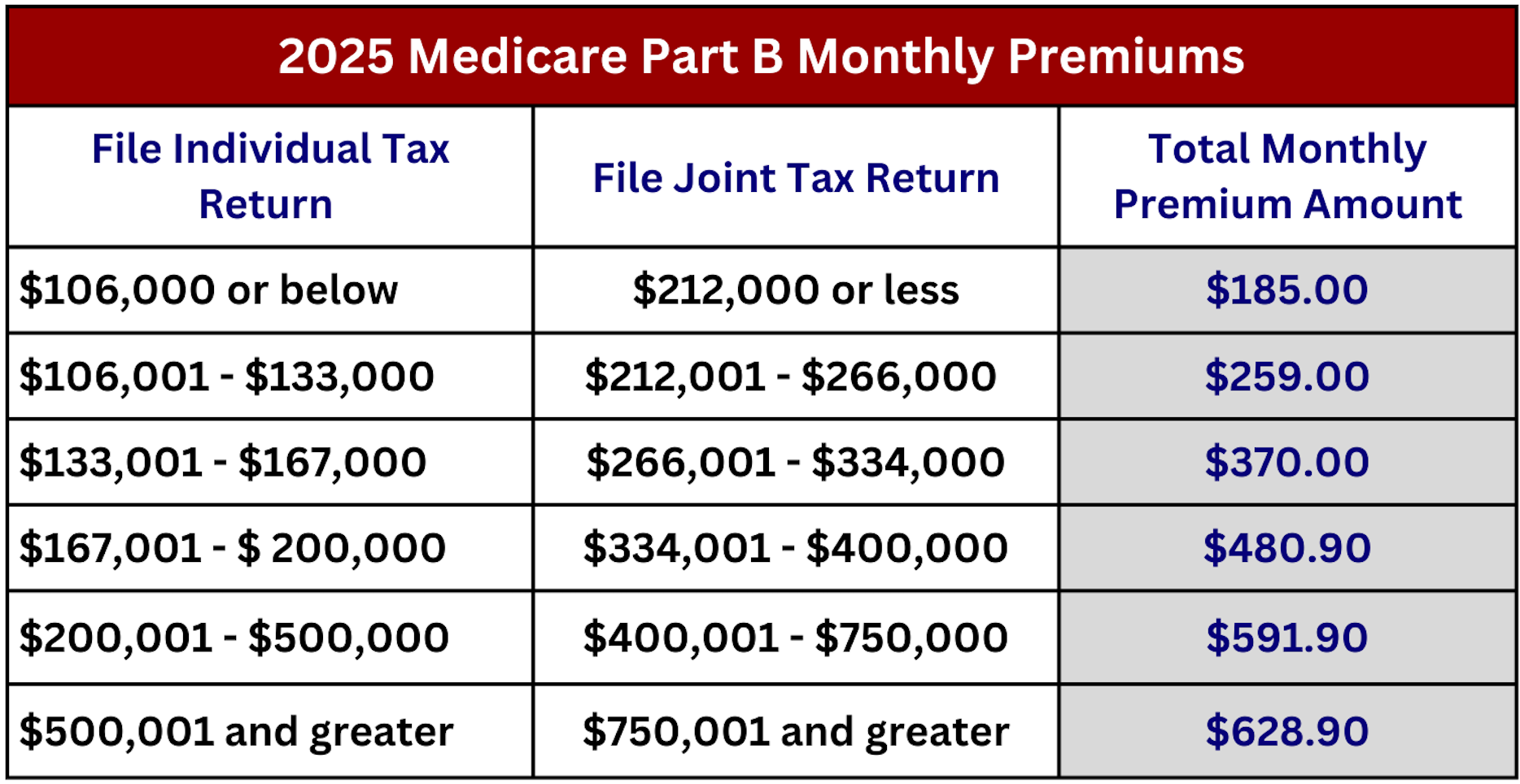

Expect to see an increase in Medicare Part B costs this year. The standard monthly premium rises to $185 (up $10.30 from 2024), while the deductible grows to $257, a $17 jump. For the approximately 8% of beneficiaries with higher incomes, premiums range between $259 and $628.90.

Part A Highlights

Costs related to Medicare Part A are also seeing changes. Here’s a snapshot:

- Premium: Up to $518/month, depending on work history.

- Deductible: $1,676, up by $44.

- Coinsurance for hospital stays:

- Days 1–60: $0.

- Days 61–90: $419/day.

- Lifetime reserve days: $838/day.

- Skilled nursing facilities (Days 21–100): $209.50/day.

Most beneficiaries don’t pay a Part A premium, but those with limited work history should note the increases.

IRMAA for Part B of Medicare

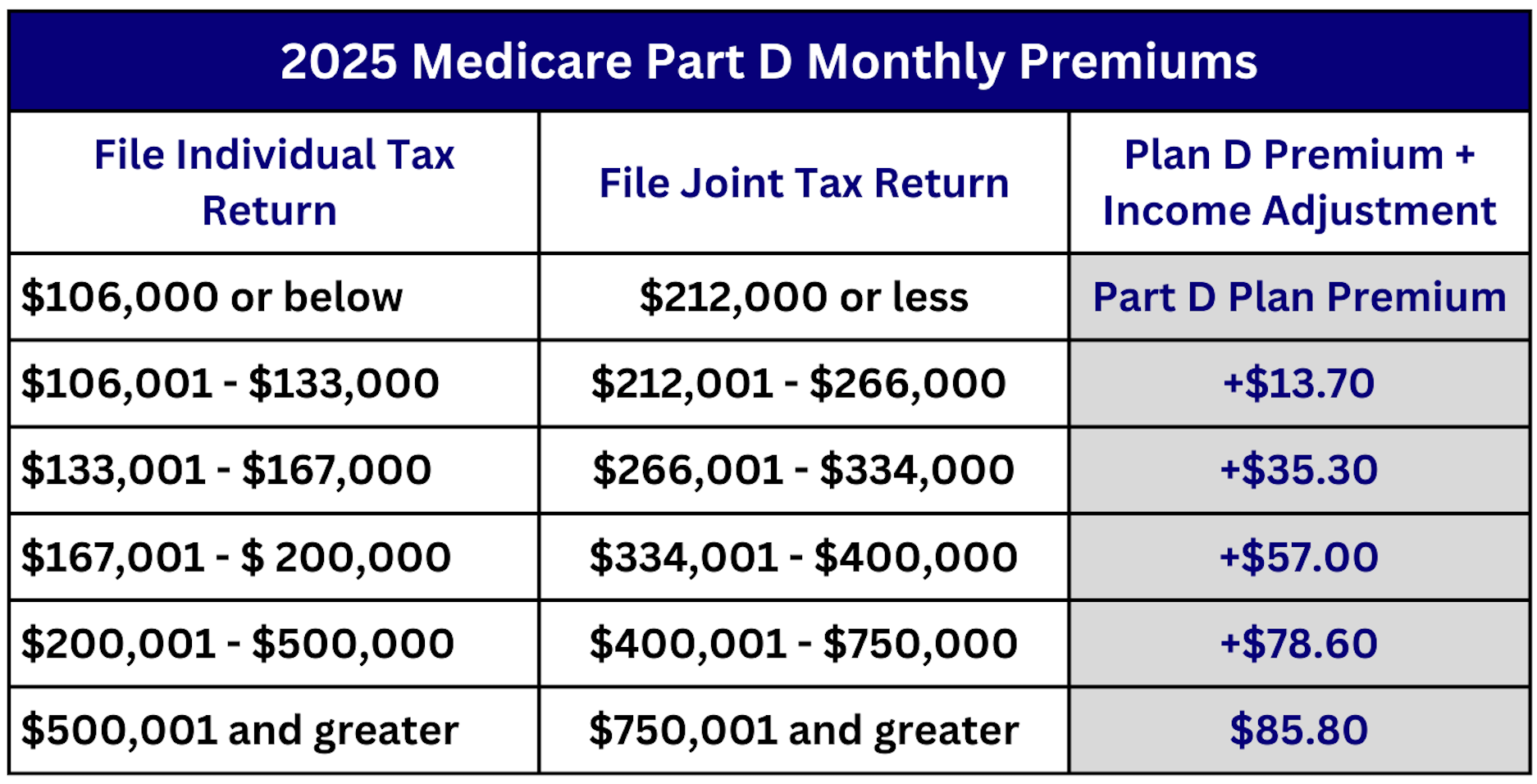

IRMAA for Part D

Medicare Advantage: Growing Enrollment and New Trends

Medicare Advantage continues to grow in popularity, with enrollment projected to surpass 36 million beneficiaries, representing 60% of Medicare users. Though the total number of plans is slightly reduced, here’s what’s trending:

- Premium Adjustments: The average premium decreases to $17, with 87% of plans under $50 and 58% offering $0 premiums. However, $0 premium plans with $0 drug deductibles are dropping from 39% in 2024 to 22% in 2025.

- Mid-Year Benefit Statements: Beneficiaries will receive a personalized statement between June 30 and July 31, detailing unused supplemental benefits. This initiative encourages better utilization of perks like dental, vision, and fitness benefits.

Compliance and Market Shifts

With these updates come new compliance requirements and market trends:

- Plan Switching: Up to 70% of beneficiaries may change plans due to shifting policies.

- Part B Rebates: Plans offering Part B rebates will see a 93% increase.

- Consent Rules: New transparency rules demand clearer consent during lead generation.

Agents play an increasingly important role in navigating these changes, ensuring clients make informed decisions about their healthcare.

Final Thoughts

Medicare’s 2025 updates underscore the importance of staying proactive. Whether it’s understanding cost changes, navigating new plan options, or maximizing benefits, there’s plenty to consider. By keeping abreast of these developments, you’ll not only guide clients effectively but also strengthen trust and credibility in the process.