Plan K is currently marketed by 15 Medicare Supplement carriers, but accounts for only 0.2% of all Medicare Supplement lives in-force as of year-end 2014. These results show that Plan K is not even on the radar for most agents in the Medicare Supplement market, however, based on how Plan K lines up against Medicare Advantage plans, maybe it should be. Let’s take a look.

Similar to how Medicare Advantage plans are designed, Plan K provides partial coverage for the benefit gaps in original Medicare.

The basics of the Plan K benefit structure are as follows:

Plan K pays at 100%:

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Medicare preventive care Part B coinsurance

Plan K pays at 50% with cost-sharing (applies to annual out-of-pocket limit):

Medicare Part A

- Inpatient hospital deductible benefit

- Skilled nursing facility care coinsurance

- First 3 pints of blood

- Hospice care copayment or coinsurance

- Medicare Part B

- First 3 pints of blood

- Copayment or coinsurance benefit

Plan K does not pay:

- Part B deductible (applies to annual out-of-pocket limit)

- Part B excess charges (do not apply to annual out-of-pocket limit)

Applicant pays cost-sharing for the above covered services or benefits until the annual out of pocket limit, $4,940 in 2015, is reached for the calendar year. Once this limit is reached, Plan K pays for 100% of all Medicare-approved costs for the remainder of the calendar year.

46% of Medicare Advantage enrollees have plans with out-of-pocket limits greater than $5,000 in 2015.

Plan K does not provide “first dollar” coverage like some Medicare Supplement plans, but it does provide 50% coverage of most benefit gaps within Medicare. Most Medicare Advantage plans have hospital inpatient and physician copayments that exceed the Plan K out-of-pocket costs if those services are utilized.

Other benefits of Medicare Supplement Plan K vs. Medicare Advantage plans:

- Plan K customers do not have to deal with provider referrals and networks of Medicare Advantage plans.

- Plan K customers do not have to deal with the changing service areas of Medicare Advantage plans.

- Plan K is guaranteed renewable, meaning a carrier cannot cancel a plan if the premium is paid. Medicare Advantage plans can be cancelled at the end of each year.

- Plan K benefits will remain fixed year-to-year, whereas Medicare Advantage plans can change benefits on a yearly basis.

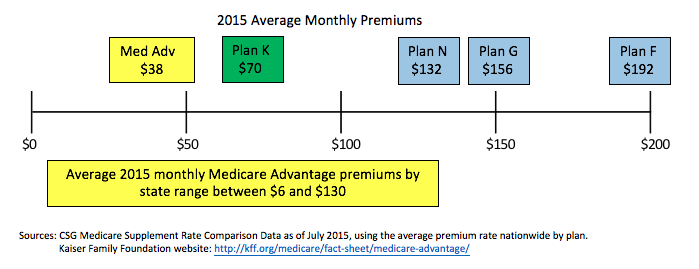

Along with the provider flexibility and plan stability advantages that Plan K has compared to Medicare Advantage plans, it also lines up better from a premium perspective than the most popular Medicare Supplement plans as follows:

According to Chris Hardin, a leading Medicare Supplement agent from Georgia, “Based on my clients’ experiences, copayments paid for Medicare Parts A and B are lower than copayments for Medicare Advantage. Purchasing a Plan K will reduce the Medicare Parts A and B copayments by half, with the copayments applying to the annual out-of-pocket limit, and allow my clients access to any physician without provider network restrictions. In addition, Plan K allows my clients to purchase a stand-alone prescription drug plan that meets their individual needs. As an example, one of my clients enrolled in a Medicare Advantage plan specifically because it has a $0 monthly premium and she could retain her physician. However, this Medicare Advantage plan would not cover her prescription of Crestor, for which she paid over $100 out-of-pocket per month. If she would have enrolled in a Medicare Supplement Plan K, she could have alternatively had a stand-alone Part D premium of $25, with a $20 co-pay for the Crestor.”

Medicare Supplement market sales have been consolidating within Plans F, G, and N, for all the reasons listed above, maybe this is the time for carriers to expand their product offerings to include Plan K. Medicare Advantage plans are certainly not going away and Plan K provides a different type of value proposition versus Medicare Advantage than other Medicare Supplement plans.

Article originally posted by Tracy Emrich and Doug Feekin | August 7, 2015 | http://csgactuarial.com/