Medicare agents are well aware that long-term care is not covered by Medicare, whether it’s in a nursing facility or at home. However, there is some coverage for home health care.

When it comes to Medicare and home health care, the topic can be quite confusing due to the numerous requirements and exceptions involved. But fear not, we are here to shed some light on the matter and provide you with clarity.

Firstly, it’s important to note that Medicare does not pay for long-term care (extensive stays), whether you’re in a nursing facility or receiving that same care at home. So, if your client finds themselves in a nursing facility, Medicare covers up to 100 days of care. However, once those 100 days are over, they are responsible for all costs. To qualify for the initial 100 days of coverage, certain criteria must be met.

On the other hand, Medicare does offer coverage for home health care. This means that if your client requires medical services (skilled level) in the comfort of their own home, Medicare can help cover some of the costs associated with home health care.

Navigating the complex world of Medicare and home health care can seem overwhelming to consumers. Our goal is to provide you with a better understanding of Medicare and home health care coverage so that you can help your clients make informed decisions about their insurance needs.

Home Health Care Is Continually Growing in Popularity

The importance of understanding the specifics of home health care and Medicare coverage cannot be overstated. With its increasing popularity over the last decade, home health care has become a crucial aspect of healthcare services. In fact, in 2013 the amount spent by Medicare for approved home health care was around $34 billion and in 2021 it had grown to over $46 billion. To see the complete breakdown by years, visit the CMS website and download the NHE Tables in the Downloads section.

As we look forward, it’s evident that the landscape of healthcare is changing rapidly. By 2034, the number of adults over the age of 65 is projected to surpass the number of children under the age of 18, as revealed by the United States Census Bureau. This demographic shift underscores the growing need for accessible and comprehensive care options for older adults.

Fortunately, home health care is here to meet the demands of our aging population. With its ability to provide personalized care in the comfort of one’s own home, it offers a compelling alternative to traditional nursing home care. Not only does it promote independence and improved quality of life, but it also offers cost-effective solutions for individuals and families.

In conclusion, the rise of home health care is an undeniable trend, and it’s one that we should pay careful attention to. As we navigate the complexities of healthcare and Medicare, understanding the benefits and available options of home health care becomes paramount. By embracing this innovative approach to care, we can ensure the well-being and longevity of our loved ones.

The allure of receiving care in the familiar surroundings of one’s home is undeniably appealing.

With these compelling advantages in mind, the question that arises is: how will your clients afford this level of care? It’s a valid consideration that demands attention and strategic planning.

How Does Medicare Coverage Work With Home Health Care?

Medicare’s coverage of home health care can be complex, filled with disclaimers and eligibility requirements that can leave individuals feeling uncertain. However, it’s important to understand Medicare’s limitations regarding home care services.

First and foremost, it’s crucial to note that Medicare does not offer coverage for 24/7 home care. While Medicare provides assistance with medically necessary home health care services, it is essential to recognize that routine activities of daily living, such as bathing, dressing, or meal preparation, fall outside Medicare’s scope.

It is always recommended to thoroughly review Medicare’s guidelines and eligibility requirements to ensure a clear understanding of what services are covered and what may need to be addressed through alternative means. By staying informed, individuals can make more informed decisions about their health care options and seek the most appropriate care for their needs.

Medicare coverage for home care is contingent upon meeting certain criteria. To qualify, the care must be part-time or intermittent, meaning it falls within the following parameters:

- Care is provided for less than 7 days per week

- Care is delivered for less than 8 hours per day up to a maximum of 21 days

However, satisfying just these two conditions alone is not sufficient. Additional requirements must be met, which include:

- Oversight and review of your care plan by a qualified doctor who actively monitors your progress.

- Certification from a doctor confirming the need for intermittent skilled nursing care, excluding blood drawing.

- Certification from a doctor stating the necessity for physical therapy, speech-language pathology, or continued occupational therapy services.

- Utilization of a Medicare-approved home health agency.

- Verification from a doctor that you are homebound, ensuring you require assistance within your residence.

By fulfilling these criteria, you can confidently navigate through the process of obtaining Medicare coverage for your home care needs.

To receive coverage for these services, certain criteria must be met. First and foremost, the services provided must be specifically tailored to address your condition in a safe and effective manner. It is imperative that the services are deemed necessary and require the expertise of qualified therapists. Additionally, the frequency, duration, and complexity of the services should be reasonable and appropriate for your individual needs.

You can establish coverage eligibility in several scenarios. Firstly, if your condition is expected to show improvement within a reasonable and predictable timeframe, coverage may be granted. Alternatively, if you require the knowledge and skill of a skilled therapist to create and implement a maintenance program for your condition, coverage may also be provided. Lastly, if you require ongoing maintenance therapy from a skilled therapist to effectively manage and treat your condition, you may be eligible for coverage.

Paying for home health care costs with a Medicare Supplement

Home health care is fully covered by Medicare if an individual meets all the necessary requirements. Medicare pays 100% for home health care services and covers 80% of the Medicare-approved amount for durable medical equipment (DME).

If your client has a Medicare Supplement plan, it will cover the remaining 20% for approved DME, so they will only be responsible for the Part B deductible. This ensures that individuals have access to the healthcare they need without incurring significant out-of-pocket expenses. It’s important to understand the coverage provided by Medicare and its supplements to make informed healthcare decisions. Remember, your clients deserve the best care possible, and Medicare is here to help.

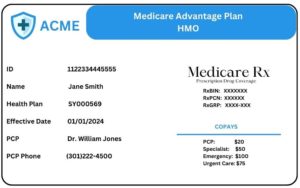

Paying for home health care costs with a Medicare Advantage plan

When it comes to Medicare Advantage plans, the out-of-pocket costs for your clients can vary depending on their specific plan and network. Let’s break it down and take a closer look.

Take a PPO plan, for example. Opting for in-network home health care services may result in no charges for your client. It’s a win-win situation. However, choosing an uncovered agency outside the network may subject them to a 35% coinsurance rate. It’s important to keep this in mind.

Now, let’s talk about HMO plans. They tend to have stricter rules. In fact, many HMOs don’t cover any home health care services if the policyholder goes out-of-network. That’s why it’s crucial to understand the limitations and make informed decisions for your clients.

Remember, the exact costs will depend on the specific Medicare Advantage plan. To ensure your clients have access to the home health care they need, it’s essential to double and triple-check the plan’s network.

Quick summary of what Medicare will cover

What do you actually need to obtain services from a Home Health Care Agency? Since Medicare covers skilled level of care, the agency must first receive notification from the physician ordering the services. The agency can then offer Medicare-approved skilled care and therapy visits.

If a patient is needing personal care, a sitter, or private duty nurses to provide other levels of care that would be deemed non-skilled, then Medicare will not approve those services and they would need to be paid out of pocket by the patient. Some of those other non-skilled services would include help with bathing, shopping, doctor appointments, and companionship.

How to find Medicare approved home health care agencies?

So how does your client or their family members find a Medicare approved home health care agency? Medicare itself provides a lookup tool that anyone can use. Simply visit https://www.medicare.gov/care-compare/?redirect=true&providerType=HomeHealth

You will need to only input some limited information to retrieve your local results such as either address or zip code. You can expand the search to include all agencies in a city or even the entire state if desired.

Offer your clients ‘peace of mind’ with home health care insurance!

As a confident and authoritative advisor, it’s crucial for you to educate your clients about the potential need for long-term care as they age. Did you know that seniors over the age of 65 have a staggering 68% chance of requiring some form of long-term care? You shouldn’t ignore this significant figure.

When discussing care options with your clients, it’s essential to mention that Medicare has certain limitations on coverage for care provided at home. This is crucial information that can help guide their decision-making process.

Fortunately, there are insurance policies available that focus specifically on assisting with the costs associated with home health care. These policies can serve as a valuable alternative to traditional long-term care insurance, offering your clients more options and peace of mind.

By providing this comprehensive information to your clients, you can demonstrate your expertise and commitment to their well-being, ensuring they make informed decisions about their healthcare needs.

Looking at different Short Term Care plans (STC)

Keep in mind, short term care plans usually serve as nursing home/assisted living plans with a home health care benefits rider. Unlike long term care plans, a STC plan will not exceed a benefit period of more than 1 year.

Aetna Short Term Care (Recovery Care)

- Issue Ages: 50-89

- Benefit Periods: 90, 180, 270, or 360 days

- Elimination Period: 0, 20, or 100 days

- Daily Benefit: Up to $300

Riders

- Home Health Care

- Weekly Benefit: Up to $1,200 weekly maximum

- Benefit Periods: 13, 26, or 52 weeks

- Hospital Indemnity

- Up to $300 per day for each day of hospital confinement

- Up to 20 days of care per period of care

- 365 day LIFETIME maximum

Guarantee Trust Life Short Term Care (Recover Cash)

- Issue Ages: 40-84

- Benefit Periods: 30, 45, 60, 90, 180, 360

- Elimination Periods: 0 or 20 days

- Daily Benefit: $50 – $300 per day

Riders

- Home Health Care

- Weekly Benefit: $50 – $1,400 per week

- Elimination Periods: 0 or 20 days

- Benefit Periods: 26 or 52 weeks

- Built in TCARE benefit.

TCARE enables family caregivers to focus on not only their family member needing care, but themselves. With comprehensive resources and support services from TCARE the family caregiver can avoid burnout. The plan will pay a $3,500 caregiver lump sum to the loved one providing care. The cash is there for them to use as they please. All the family member needs to do is register with TCARE, complete the family caregiver assessment, check-in each quarter with a TCARE specialist for ongoing support.

- Inflation Rider

- Simple – for each year the policy is in force the base daily maximum benefit amount will increase by 5% of the original benefit amount selected at time of application.

- Compounding – for each year the policy is in force the base daily maximum benefit amount will increase by 5% compounded annually for the life of the policy.

CONCLUSION

The simple truth is that your clients would prefer to recover in the comfort of their own home. Almost no one says to themselves “Hey, I would rather go to a nursing home to recover!” With this in mind, it really is not a hard conversation to have with your clients. Something as simple as taking a moment to review with them exactly what skilled level of care is and how limited the benefits from Medicare, Medicare Advantage, and Medicare Supplement plans are, you can show them how a STC plan covers all 3 levels of care (Skilled, Intermediate, and Custodial). The STC plan excels here, as it extends beyond just providing skilled care.

Your clients can be receiving skilled level of care and have it covered thru Medicare while receiving custodial care and having that paid for by their STC plan. Call us today to get contracted at (800)924-4727.