Virginia Legislature Passes Medicare Birthday Rule Bill

Virginia has joined several other states in enhancing Medicare protections for seniors by adopting the Medicare birthday rule. The legislation marks a significant shift in how Virginia residents can manage their Medicare Supplement insurance, commonly known as Medigap policies.

In early 2025, Virginia lawmakers introduced legislation to create an annual enrollment opportunity for Medicare Supplement policyholders. The proposal aimed to provide greater flexibility for seniors seeking to change their coverage, particularly those who might be paying excessive premiums or needing different benefits.

How the Bill Moved Through the Legislature

The journey of Virginia’s birthday rule legislation through the state legislature reveals the careful consideration given to this policy change. Initially, the bill was introduced as HB 64 by Delegate Ellen H. Campbell 1. This proposal followed similar legislative efforts in other states, establishing what policy experts refer to as a “birthday rule” for Medicare Supplement policies.

The legislative process included significant debate about the bill’s specific provisions. As with many healthcare-related bills, various stakeholders provided input that shaped the final legislation. The National Association of Benefits and Insurance Professionals (NABIP) Virginia chapter played a notable role in the discussions, sharing expertise on potential challenges with birthday rule implementation 2.

Throughout the legislative journey, the bill underwent several modifications. One crucial change involved the language regarding what types of plans enrollees could switch to during their birthday period. The original bill language allowed for switching to plans offering “the same benefits as or lesser benefits than” current coverage 1. However, at some point during the legislative process, lawmakers modified this language by removing the word “lesser” 3.

The significance of this change was substantial. Without the “lesser” language, the bill would technically not allow beneficiaries to downgrade their plans (such as moving from Plan F to Plan G, or Plan G to Plan N) to save money 3. Nevertheless, the bill continued to move forward through the legislative chambers.

Interestingly, this was not the only birthday rule legislation introduced in Virginia’s 2025 legislative session. According to MedicareResources.org, a second bill was introduced that would allow enrollees to switch to any other plan of equal or lesser benefits, and this alternative bill was approved by the state House in early February 2025 4. This indicates the level of interest among Virginia lawmakers in providing this type of protection for Medicare beneficiaries.

The path to passage wasn’t entirely smooth. Some legislative sources suggested that birthday rule legislation might face challenges. According to NABIP reports, after discussions with the bill’s sponsor during their advocacy day, “much of the initial support for the bill was lost” 2. These same sources indicated the possibility that the birthday rule language might be considered a “basket bill” – legislation that leadership distributes to freshman members to give them bills to sponsor and potentially provide an easy early victory 2.

Despite these potential hurdles, the legislature ultimately approved the birthday rule legislation, demonstrating Virginia’s commitment to expanding healthcare options for seniors.

Key Provisions of Virginia’s Birthday Rule

The final version of Virginia’s Medicare birthday rule includes several important provisions that will directly impact Medicare beneficiaries throughout the Commonwealth:

- Annual Enrollment Period: The law establishes an annual open enrollment period that commences on the individual’s birthday and remains open for at least 30 days thereafter 1. This creates a predictable, annual opportunity for Medicare Supplement policyholders to reconsider their coverage.

- Plan Change Options: The legislation permits individuals to purchase any Medicare Supplement policy made available by insurers in Virginia that offers the same benefits as their current coverage 3. There remains some question about whether the final version restored the ability to switch to plans with lesser benefits, which would allow beneficiaries to downgrade to less expensive plans if desired.

- Consumer Notification Requirements: A critical consumer protection element of the law requires insurers to notify each eligible individual at least 15 days but not more than 30 days prior to the commencement of their annual open enrollment period 1. This notification must include:

- The specific dates of the individual’s open enrollment period

- Clear explanation of the rights available during that period

- Information about any modification of benefits or premium adjustments for Medicare Supplement policies

This notification requirement represents an important safeguard, ensuring that beneficiaries are aware of their opportunities to make coverage changes. It places the responsibility on insurance companies to proactively inform their customers about this annual right.

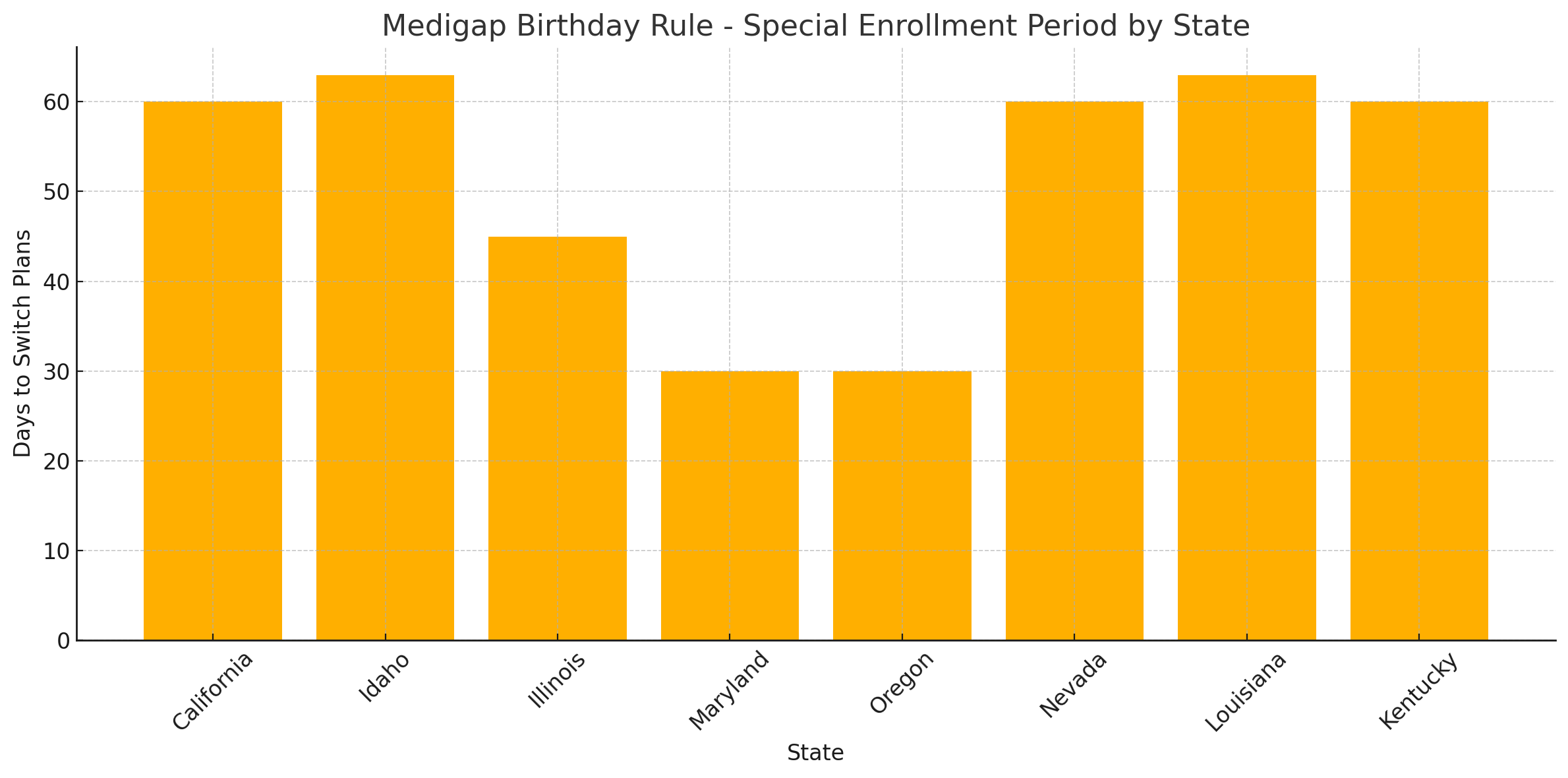

The provisions in Virginia’s birthday rule are similar to those implemented in other states but contain some specific elements tailored to Virginia’s insurance market and regulatory framework. As of June 2024, nine other states had enacted some type of Medigap birthday rule: California, Idaho, Illinois, Kentucky, Louisiana, Maryland, Nevada, Oklahoma, and Oregon 5. Each state’s implementation varies in terms of the enrollment window length, carrier-switching options, and coverage change limitations.

For instance, the window in Idaho extends 63 days after a beneficiary’s birthday, while in Maryland it lasts only 30 days 5. Some states also have age limitations, such as Illinois, which only allows the birthday rule up to and including age 75 5. Virginia’s 30-day window places it in line with several other states’ policies.

It’s worth noting that the birthday rule differs significantly from Medicare’s standard enrollment periods. The typical Medicare Annual Enrollment Period runs from October 15 to December 7 each year 6, while the Medicare Advantage Open Enrollment Period operates from January 1 through March 31 7. Unlike these fixed calendar periods, the birthday rule creates a personalized enrollment window tied to each beneficiary’s birth date.

Furthermore, the birthday rule only applies to individuals who already carry a Medigap plan, making it a tool for plan switching rather than initial enrollment 5. This distinguishes it from initial enrollment periods and makes it particularly valuable for long-term Medicare beneficiaries who may have changing healthcare needs or financial situations.

Virginia’s adoption of the birthday rule places it among a growing number of states recognizing the need for greater Medicare Supplement flexibility. The rule’s provisions work alongside other Medicare enrollment periods, giving Virginia seniors multiple opportunities throughout the year to optimize their healthcare coverage.

In addition to the birthday rule provisions, Virginia has recently expanded other Medicare protections. Effective January 1, 2024, Virginia law established a new six-month open enrollment period for individuals under age 65 who are Medicare-eligible due to End-Stage Renal Disease (ESRD) 8. This earlier policy change ensured that these vulnerable individuals could access Medigap coverage without medical underwriting or pre-existing condition limitations, provided they had at least six months of continuous creditable coverage 8.

Another important protection implemented alongside that 2024 change was the requirement that premium rates for Medicare-eligible individuals under 65 cannot be higher than rates charged to Medicare-eligible individuals aged 65 for the same plan 8. This rate protection ensures that younger Medicare beneficiaries with disabilities don’t face discriminatory pricing.

Together with these earlier protections, the new birthday rule creates a more comprehensive framework of Medicare Supplement options for Virginia residents.

Effective Date and Implementation Timeline

The Medicare birthday rule in Virginia will take effect on July 1, 2025 3. This implementation date gives insurance companies, beneficiaries, and regulatory agencies several months to prepare for the new policy.

The timeline for implementation includes several key milestones:

- Bill Signing: The Governor signed the birthday rule legislation on March 24, 2025 3

- Preparation Period: March 25 – June 30, 2025 (Insurance companies prepare systems and materials)

- Effective Date: July 1, 2025 3

- First Eligible Birthday Periods: Beginning July 1, 2025, for individuals with birthdays on or after that date

For Virginia residents with birthdays in July, they will be among the first beneficiaries eligible to utilize this new enrollment opportunity. Those with birthdays later in the year will have their respective 30-day windows beginning on their birthdays.

The legislation’s effective date means that insurance companies offering Medicare Supplement policies in Virginia must be prepared to:

- Process applications during these new enrollment windows

- Provide required notifications to policyholders approaching their birthdays

- Issue policies according to the new rules without medical underwriting

- Adjust systems and training to accommodate the changes

Prior to the birthday rule’s implementation, Virginians with Medicare Supplement policies faced more limited options if they wanted to change their coverage outside their initial Medigap open enrollment period. Without guaranteed issue rights, many would need to go through medical underwriting, a process where insurance companies review health history and may charge higher premiums or deny coverage based on pre-existing conditions.

The July implementation date aligns with the start of Virginia’s fiscal year, a common effective date for new legislation in the Commonwealth. This timing provides a clean transition point for regulatory agencies and insurance providers.

It’s important for Medicare beneficiaries to understand that the birthday rule does not replace or override other Medicare enrollment periods. The standard Medicare Annual Enrollment Period (October 15-December 7) 6 and Medicare Advantage Open Enrollment Period (January 1-March 31) 7 will continue to operate alongside the new birthday rule. However, while these standard periods allow changes between Original Medicare and Medicare Advantage plans, the birthday rule specifically addresses Medicare Supplement policies only.

The effective date of July 1, 2025, demonstrates the legislature’s intent to implement this consumer protection promptly while still allowing sufficient preparation time. This balance suggests careful consideration of both beneficiary needs and industry implementation requirements.

For Virginia Medicare beneficiaries, particularly those paying high premiums or experiencing changes in healthcare needs, the upcoming implementation represents a valuable new opportunity to optimize their coverage. Furthermore, the notification requirements ensure that beneficiaries will receive timely reminders about their rights under the new law.

The birthday rule’s implementation follows a national trend of expanding Medigap enrollment opportunities beyond the traditional once-in-a-lifetime initial enrollment period. While federal regulations establish minimum standards for Medicare Supplement policies, states have increasingly taken action to provide additional consumer protections and enrollment rights through mechanisms like the birthday rule.

Virginia’s adoption of this policy places it among states recognizing that healthcare needs and financial circumstances change over time, and that seniors deserve regular opportunities to reassess and adjust their Medicare Supplement coverage accordingly.

Other States With Birthday Rule

The following states have already implemented the ‘birthday rule’:

California

Starting from the first day of your birth month, California residents are granted a 60-day window to switch to another Medigap plan that offers either identical or reduced benefits. This timeframe also allows for switching to a different insurance company. This extended opportunity became effective on January 1, 2020, replacing the previous 30-day limit that was in place before that date.

Idaho

In Idaho, beneficiaries have 63 days from their birthday to make a change to another Medigap plan, as long as the new plan matches or lowers the benefits of the current plan. The rule also permits enrollees to change insurance providers. This birthday-related enrollment period began on March 1, 2022.

Illinois

Illinois residents between the ages of 65 and 75 are eligible for a 45-day period starting on their birthday during which they may transition to another Medigap policy that offers the same or fewer benefits. However, this only applies to plans offered by their current insurer or an affiliated company—a provision added through legislation passed in 2024. The rule has been in effect since January 1, 2022.

Maryland

In Maryland, Medicare beneficiaries have a 30-day window following their birthday to switch to a Medigap plan that is either equivalent in coverage or less comprehensive than their current plan. This regulation took effect on July 1, 2023.

Oregon

Oregon’s birthday rule provides a 30-day period beginning on the first day of the beneficiary’s birth month. During this time, enrollees can change to a Medigap plan offering the same or reduced coverage and can also change insurance carriers. This long-standing rule has been active since January 1, 2013.

Nevada

Nevada follows a similar approach to California and Oregon, granting residents 60 days starting from the first day of their birth month to switch to another Medigap plan with equal or lesser benefits. Insurance carriers can also be changed during this period. This policy took effect on January 1, 2022.

Louisiana

In Louisiana, beneficiaries are given 63 days from their birthday to switch to another Medigap plan that provides the same or fewer benefits. However, this option is limited to plans offered by the current insurer or its affiliated companies. These provisions became official following legislation passed in 2023.

Kentucky

As of January 1, 2024, Kentucky law permits Medigap enrollees to switch to an equivalent plan offered by a different insurer. This switch must be made within 60 days of the enrollee’s birthday, and the new plan must provide the same level of benefits as the existing one.

References

[1] – https://legacylis.virginia.gov/cgi-bin/legp604.exe?241+sum+HB64

[2] – https://nabip.org/media/9785/state-update-quarterly-report-10-24.pdf

[3] – https://www.reddit.com/r/medicare/comments/1jjkhn2/governor_just_signed_the_medicare_birthday_rule/

[4] – https://www.medicareresources.org/medicare-eligibility-and-enrollment/the-birthday-rule-a-gift-to-medigap-enrollees/

[5] – https://wtop.com/news/2024/06/what-is-the-medigap-birthday-rule-and-which-states-have-it/

[6] – https://www.cms.gov/priorities/key-initiatives/medicare-open-enrollment-partner-resources

[7] – https://www.vmfh.org/our-services/wellness-resources/medicare-resources/medicare-enrollment-periods

[8] – https://www.scc.virginia.gov/consumers/insurance/health-insurance-consumer/tips,-guides-publications/virginia-medigap-guide/