The GTL Hospital Indemnity plan is not only one of the best of its kind in the marketplace, but it is also one of the longest-established plans. Since first introducing their Advantage Plus product in 2005, there has not been one rate increase over the last 18 years. That is a pretty amazing accomplishment in its own right. In addition to that, GTL has worked with its field force to constantly enhance the product over the years which now has evolved into the Advantage Plus Elite plan available for sale.

Plan Underwriting Highlights

In the states where the Advantage Plus Elite is now available (click here for the current approval chart), the plan is filled with rich benefits. Here is a quick summary of the underwriting:

- Guaranteed Issue from ages 64.5 to 68

- Issue Ages 40-85

- Only 5 health questions

- No tobacco rate or question

Base Plan Benefits

- Base plan benefit choices include 1 day, 3, 4, 5, 6, 7, 8, 9, 10, or 15 Days

- Daily Benefit Amounts up to $750 (for 1 day option the daily benefit is up to $2,500)

- Included Base Benefits

- Short Duration Hospital Stay – the patient is hospitalized and discharged between 6 and 24 hours for either observation or confinement, the policyholder will receive the chosen daily benefit under this provision. (if 1 day benefit was chosen then 25% of the daily benefit will be paid out)

- Emergency Room Benefits – will pay policyholders $150 if they are treated in an emergency room, emergency care, or urgent care facility due to an accident or injury. No hospital admission is required.

- Mental Health Benefits – will pay policyholder $175 per day for up to 7 days if confined to a hospital for a mental or nervous disorder. The benefit is paid in lieu of the hospital confinement benefit for sickness or injury.

Optional Riders

- Ambulance Benefit Rider – benefit amount of $50 up to $400 per ground or air ambulance ride to or from a hospital.

- Outpatient Therapy Rider – pays $50 daily benefit for each day the policyholder receives physical, occupational, or speech therapy on an outpatient basis. The benefit also includes chiropractic therapy covered at $50 per day up to 5 days per calendar year.

- Cancer Lump Sum Rider – Cash benefit of $2,500, $5,000, $7,500, $10,000, $15,000, or $20,000

- Outpatient Surgical Rider – benefit of $250,$500, $750, or $1,000 for a surgical procedure performed in an ambulatory surgical center or outpatient hospital facility. Payable up to 2 times per calendar year.

- Lump Sum Hospital Rider – In addition to the daily benefit amount chosen this rider will pay an extra $250, $500, or $750 lump sum payment.

- Dental & Vision Rider – pays an annual benefit of up to $400, $800, or $1,200 for services performed by a licensed dentist, ophthalmologist, or optometrist after the first year. Includes a $200 benefit for prescription eyeglasses or contact lenses (Not Available in GA, MD, MN, MO, ND, TN, or VA).

Key Points To Remember

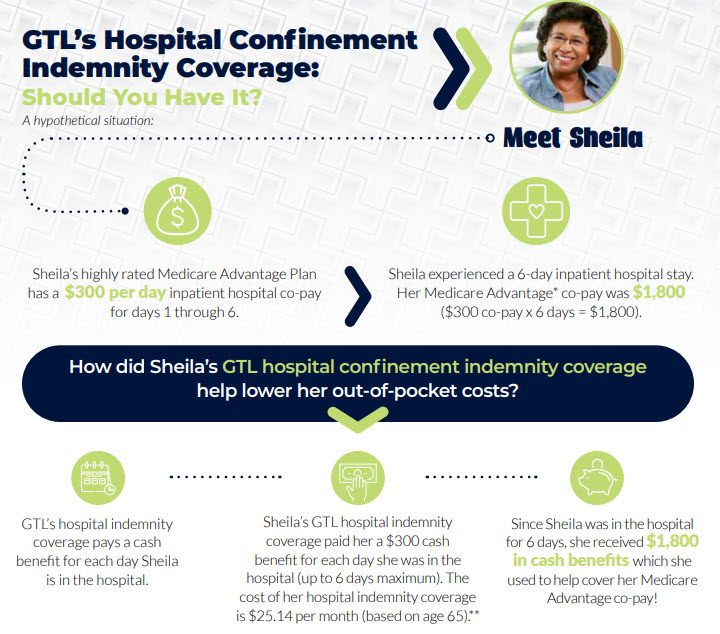

- Benefits are paid directly to the policyholder and can be used in any way they choose!

- Great plan for those with a Medicare Advantage plan that has high daily hospital co-payments.

- Rates don’t increase as you age

- No Limits to Policy Lifetime Benefits received.

- Very Affordable Rates!!

Takeaway

The GTL hospital indemnity plan is by far our favorite HIP plan on the market. It is not only one of the most competitively priced plans but also offers so many options that allow the agent to customize a plan for each of their client’s exact needs. To find out more or get your contract today, call the Marketing department at (800)924-4727.